Access to Crypto

Achieve a strategic edge through competitive pricing, broad liquidity pools, and minimal latency

Advanced Aggregation, Liquidity Management & Distribution Platform

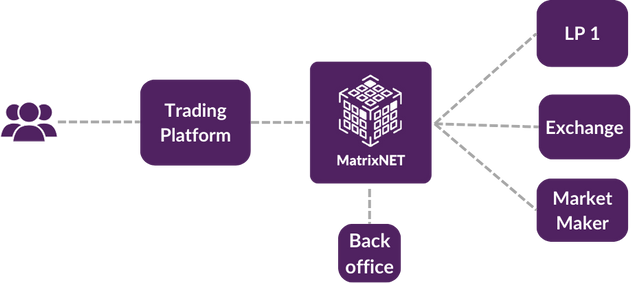

MatrixNET empowers you with unmatched capabilities for institutional crypto trading. At its heart lies the ability to seamlessly consume and distribute crypto liquidity across Market Makers, Exchanges and traditional LP’s.

MatrixNET delivers a competitive edge, enabling you to boost profits. Experience tighter spreads, deeper liquidity, and astonishingly low latency, resulting in consistently superior pricing dynamics that empower institutions to thrive in the ever-evolving crypto landscape.

This robust technology offers institutional-grade custody solutions, safeguarding digital asset holdings against potential threats.

Join institutions worldwide who trust Gold-i to elevate their cryptocurrency offering, including Crypto Brokers, Digital Asset Funds and Prop firms. Discover the power of advanced aggregation, liquidity management, and distribution—unlock new possibilities with MatrixNET today.

Liquidity Aggregation

- Price and trade with 30+ crypto venues

- Multiple smart routing aggregation methods

- Tools to manage the differences between retail exchange prices and institutional flow

Liquidity Distribution

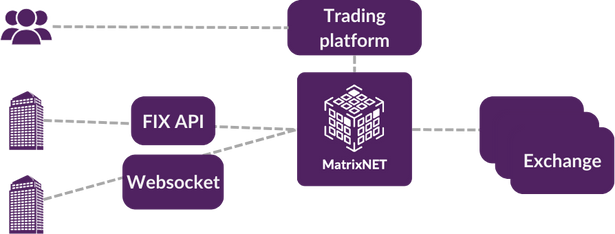

- Well-established and widely connected API

- Create your own set of prices to target different customers

- Offer FIX or Websocket

Prime Broker

- Integrated with the leading Crypto prime brokers

- Leverage Gold-i's industry relationships

- Access institutional-grade liquidity from multiple venues

Your choice of OMS/EMS

- Works with any FIX or Websocket capable trading platform

- Pre-integrated with most of the leading providers

- No need to re-write your entire infrastructure

Internalise orders

- Precision reports to identify toxic trading

- B-book / Warehousing / evaluation accounts

- Protective delay logic

Why Choose Gold-i?

Speed of Setup

- We know the market is moving fast

- Our software is designed to be setup and configured fast

- Typical setup from start to finish is only a few days

Years of experience

- When you work with Gold-i we become your partner

- A leading figure in the crypto industry for 5+ years

- 24/7 expert support

- Get introductions to many crypto firms with a variety of specialities

Who can we help

- Crypto Exchanges

- Crypto Brokers

- Digital Asset Funds

- Prop firms

- Traditional finance wanting to enter crypto

Crypto FAQ's

There is a growing number of institutions seeing demand from their clients who want to invest in digital assets.

The difficulty faced by many is implementing a solution from the ground up that meets all their requirements, including access to deep liquidity, risk mitigation, settlement with multiple parties and time to build and implement such a solution.

MatrixNET Crypto offers an end-to-end solution for the access and trading of Crypto and digital assets fit for institutional needs.

No, MatrixNET Crypto is a digital asset technology platform. However, it essentially works similarly to a Prime Broker relationship, whereby you trade against several aggregated market makers and clear/settle with a single counterparty. We offer two variations of this setup, a centrally settled model or a centrally cleared model.

MatrixNET technology allows you to manage and aggregate Crypto feeds, through a direct FIX API connection. Graphically, this platform has the most comprehensive administration and monitoring suite, making it simple to set up and use on a day-to-day basis.

Primary and secondary liquidity feeds can be configured for all instruments, pools and streams enabling frictionless Fail-over and Fail-back. Multiple configurations may be created and loaded as required, encompassing parameters such as Best-bid or offer, Sweep-the-book and Primary/Secondary configuration of specific LPs.

Using the MatrixNET monitor you can view incoming pools for specific symbols to analyse market depth and the outgoing pricing stream.

No, collateral is stored with the central clearinghouse, if using the centrally cleared model, or with the various counterparties involved in the centrally settled model.

Gold-i have a team with a proven track record in FX and are now applying this expertise to the Crypto market. By using the proven, long standing MatrixNET technology, clients are confidence in reliability and functionality.

- Crypto Exchanges

- Crypto Brokers

- Digital Asset Funds

- Prop firms

- Traditional finance wanting to enter crypto